Welcome to our guide on how reverse mortgages work. In this article, we will provide you with a comprehensive understanding of what a reverse mortgage is and how it operates. Whether you are a homeowner looking for additional income or a family member interested in assisting a loved one, this guide will equip you with the knowledge you need to make informed decisions. So, let’s dive in and explore the world of reverse mortgages!

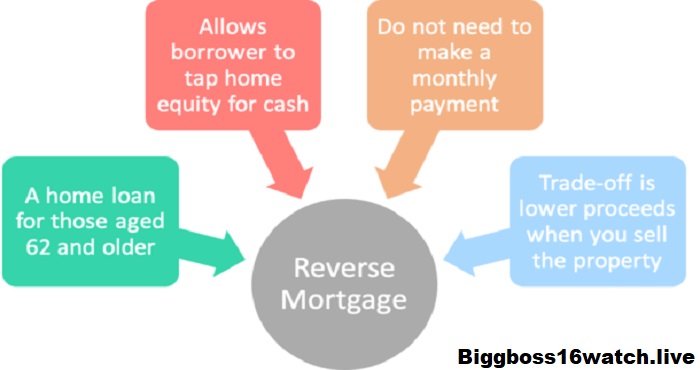

A reverse mortgage is a financial product available to homeowners, typically older adults aged 62 and above, that allows them to convert a portion of their home equity into cash without having to sell their home or make monthly mortgage payments. Reverse mortgages are often used as a financial tool to supplement retirement income or cover unexpected expenses. Here’s how they generally work:

- Qualification: To qualify for a reverse mortgage, homeowners must be at least 62 years old and have significant equity in their home. The home must also be their primary residence.

- Loan Types: There are several types of reverse mortgages, but the most common is the Home Equity Conversion Mortgage (HECM), which is insured by the Federal Housing Administration (FHA). Private lenders also offer proprietary reverse mortgages.

- Loan Amount: The amount a homeowner can borrow through a reverse mortgage depends on factors such as the age of the youngest borrower, the appraised value of the home, and current interest rates. Generally, the older the borrower and the more valuable the home, the more money can be borrowed.

- Payment Options: With a reverse mortgage, homeowners have several options for receiving payments:

- Lump Sum: A one-time payment of the entire loan amount.

- Term Payments: Fixed monthly payments for a specific term.

- Tenure Payments: Fixed monthly payments for as long as the borrower remains in the home.

- Line of Credit: Access to a line of credit that can be drawn upon as needed.

- Combination: A combination of lump sum, term payments, tenure payments, and/or a line of credit.

- Interest and Fees: Interest accrues on the outstanding balance of the reverse mortgage over time. Borrowers are typically responsible for paying closing costs and ongoing servicing fees, which can include origination fees, mortgage insurance premiums, appraisal fees, and other charges.

- Repayment: Unlike traditional mortgages, where borrowers make monthly payments to reduce their loan balance, reverse mortgage borrowers do not need to make monthly payments as long as they continue to live in the home as their primary residence. The loan becomes due when the borrower permanently moves out of the home, sells the home, or passes away. At that point, the borrower or their heirs must repay the loan balance, typically by selling the home. If the home is sold for more than the loan balance, the borrower or their heirs receive the remaining equity. If the home is sold for less than the loan balance, the FHA insurance (for HECM loans) covers the shortfall, and neither the borrower nor their heirs are responsible for the difference.

- Counseling: Before obtaining a reverse mortgage, homeowners are required to undergo counseling with a HUD-approved counselor. This counseling session helps homeowners understand the benefits and risks of reverse mortgages and ensures they fully understand the terms of the loan.

Chapter 1: Understanding Reverse Mortgages

In this chapter, we will cover the fundamentals of reverse mortgages. We will explain what exactly a reverse mortgage is, who is eligible for one, and how it differs from a traditional mortgage. By the end of this chapter, you will have a clear understanding of the basic concept behind reverse mortgages.

Chapter 2: Types of Reverse Mortgages

In Chapter 2, we will delve into the different types of reverse mortgages available. There are several options to choose from, each with its own set of features and requirements. We will discuss the two most common types: Home Equity Conversion Mortgages (HECMs) and Proprietary Reverse Mortgages. By the end of this chapter, you will have a solid grasp of the various options at your disposal.

Chapter 3: Qualifying for a Reverse Mortgage

Chapter 3 will guide you through the eligibility criteria for reverse mortgages. We will cover age requirements, property qualifications, and financial assessments. This chapter will help you determine whether you or your loved one is eligible for a reverse mortgage.

Chapter 4: How Reverse Mortgages are Repaid

In this chapter, we will explain how reverse mortgages are repaid. Contrary to traditional mortgages, reverse mortgages have unique repayment terms. We will explore the different options available for repaying a reverse mortgage and discuss the implications of each choice.

Chapter 5: Advantages and Considerations

Chapter 5 will provide an overview of the advantages and considerations associated with reverse mortgages. We will outline the benefits of obtaining a reverse mortgage, such as accessing funds for retirement or healthcare expenses, while also highlighting important factors to consider, such as potential impacts on inheritance and home equity.

Chapter 6: Alternatives to Reverse Mortgages

For those who may be unsure about reverse mortgages or want to explore other options, Chapter 6 will introduce alternative solutions. We will discuss possible alternatives and help you make an informed decision based on your specific circumstances.

Chapter 7: Researching Reverse Mortgage Lenders

In this chapter, we will guide you through the process of researching reverse mortgage lenders. We will provide tips on what to look for in a reputable lender, how to compare offers, and where to find reliable resources for your research. This chapter aims to empower you to make the best possible choice when selecting a lender.

Chapter 8: Common Misconceptions

Chapter 8 will address common misconceptions surrounding reverse mortgages. There are many myths and misunderstandings about reverse mortgages, and we will debunk them with accurate information and facts. By the end of this chapter, you will have a clear understanding of the truth behind these misconceptions.

Chapter 9: Making an Informed Decision

In the final chapter, we will compile all the knowledge we have gained throughout this guide to help you make an informed decision regarding reverse mortgages. We will recap the key points, provide additional resources for further research, and offer guidance on how to proceed. By the end of this chapter, you will be equipped to make a confident and educated choice.

We hope this guide has provided you with valuable insights into how reverse mortgages work. Remember, reverse mortgages can be a viable financial tool for homeowners in specific situations, but it’s crucial to thoroughly understand the process and implications before making any decisions. If you have any remaining questions or concerns, we encourage you to consult with a certified reverse mortgage specialist. Best of luck on your journey!