Commercial Mortgages for Business Finance & Funding. In this guide, we will provide you with all the essential information you need to know about commercial mortgages, including what they are, how they work, and the benefits they offer for business owners like yourself. Whether you are looking to purchase a new commercial property, refinance an existing loan, or expand your business, a commercial mortgage can be an excellent financial tool to achieve your goals.

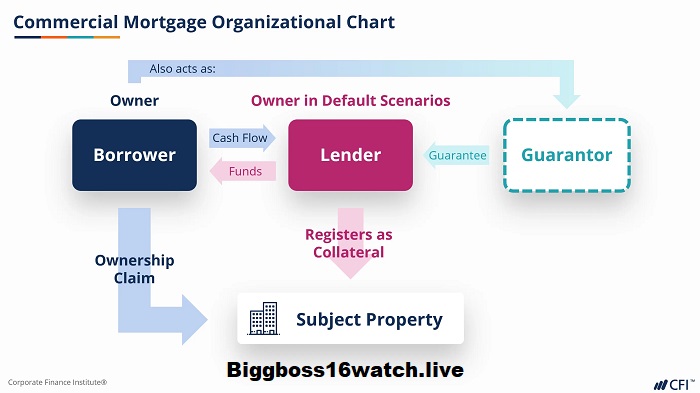

Here’s How Commercial Mortgages Generally Work:

- Property Types: Commercial mortgages are used to finance various types of income-producing properties, including office buildings, retail centers, industrial properties, multifamily residential buildings, hotels, and mixed-use developments.

- Loan Amounts: Commercial mortgages typically involve larger loan amounts compared to residential mortgages due to the higher value of commercial properties. Loan amounts can range from hundreds of thousands to tens of millions of dollars, depending on the property’s value, cash flow, and other factors.

- Loan Terms: Commercial mortgage terms vary but are typically shorter than residential mortgages. Common loan terms range from 5 to 20 years, with amortization periods of up to 25 or 30 years. However, balloon payments may be required at the end of the term, meaning the remaining principal balance must be paid in full or refinanced.

- Interest Rates: Commercial mortgage interest rates can be either fixed or variable, depending on a number of variables, including the loan-to-value ratio, the location and condition of the property, the borrower’s creditworthiness, and current market rates. Commercial mortgage rates are often higher than residential mortgage rates due to the increased risk associated with commercial properties.

- Down Payment: Lenders typically require larger down payments for commercial mortgages compared to residential mortgages. Down payment requirements can range from 10% to 40% of the property’s purchase price, depending on factors such as the property type, location, and borrower’s credit profile.

- Income Verification: Lenders evaluate the income-generating potential of the property to determine the borrower’s ability to repay the loan. This may involve analyzing the property’s rental income, occupancy rates, expenses, and cash flow projections.

- Underwriting Process: The underwriting process for commercial mortgages involves a thorough evaluation of the borrower’s financials, credit history, business plan, and the property’s financial performance and market conditions. Lenders may also require appraisals, environmental assessments, and other due diligence to assess the property’s value and risk.

- Repayment: Borrowers make regular monthly payments to repay the principal and interest on the commercial mortgage. Payments are typically based on a fixed or variable interest rate and are structured to fully amortize the loan over the term.

Understanding Commercial Mortgages

Before we delve into the details, let’s first understand what a commercial mortgage is and how it differs from a residential mortgage. While residential mortgages are used to finance residential properties, such as homes and apartments, commercial mortgages are specifically designed for financing commercial properties such as office buildings, retail spaces, warehouses, and industrial complexes.

Businesses usually seek commercial mortgages to purchase or refinance commercial real estate, which may be extremely important assets to a firm. These mortgages come with specific terms and conditions that are tailored to meet the needs of businesses, including loan amounts, interest rates, and repayment terms.

Benefits of Commercial Mortgages

Commercial mortgages offer several benefits for business owners, making them an attractive financing option. Here are some of the key advantages:

- Long-Term Financing: Commercial mortgages provide long-term financing solutions, allowing businesses to spread their loan repayments over several years or even decades.

- Asset Ownership: By securing a commercial mortgage, businesses can become owners of valuable commercial properties, which can appreciate in value over time and serve as an additional source of income.

- Fixed Interest Rates: Unlike some other forms of business financing, commercial mortgages often come with fixed interest rates, providing predictability and stability for budgeting purposes.

- Tax Deductions: Depending on your location and specific circumstances, you may be eligible for certain tax deductions on interest payments made towards your commercial mortgage.

- Opportunity for Growth: Commercial mortgages can enable businesses to expand their operations by purchasing larger or additional properties, thus fueling growth and increasing revenue potential.

Types of Commercial Mortgages

There are various types of commercial mortgages available, each catering to different financing needs and property types. Here are some of the most common types:

1. Fixed-Rate Mortgages

With a fixed-rate commercial mortgage, the interest rate remains constant throughout the loan term, providing stability and predictability for borrowers. This type of mortgage is often suitable for businesses that prefer consistent monthly payments and want to avoid the fluctuations that come with adjustable-rate mortgages.

2. Adjustable-Rate Mortgages (ARMs)

Unlike fixed-rate mortgages, adjustable-rate mortgages come with interest rates that are subject to change over time. The initial period of the loan usually has a fixed rate, which then adjusts periodically based on market conditions. ARMs are a suitable option if you anticipate interest rates to remain low or expect to refinance or sell the property before the adjustment period begins.

3. Balloon Mortgages

Balloon mortgages offer lower monthly payments initially, followed by a large payment, known as a balloon payment, due at the end of the loan term. This sort of mortgage is frequently employed by businesses who want to refinance or sell their property before the balloon payment is due.

4. SBA 504 Loans

The Small Business Administration (SBA) offers the 504 Loan Program, which provides long-term, fixed-rate financing for small businesses to acquire fixed assets, including commercial real estate. The SBA partially guarantees these loans, which frequently have attractive conditions and interest rates.

5. Bridge Loans

Bridge loans are short-term loans that provide immediate financing until a more permanent solution, such as a long-term commercial mortgage, can be secured. The SBA partially guarantees these loans, which frequently have attractive conditions and interest rates.

The Commercial Mortgage Application Process

Now that you have a better understanding of commercial mortgages, let’s dive into the application process. Obtaining a commercial mortgage involves several steps, and it’s essential to be prepared to increase your chances of approval:

1. Gather the Necessary Documents

Before applying for a commercial mortgage, you’ll need to gather and organize all the required documentation. This typically includes:

- Two to three years of business financial statements

- Personal and business tax returns

- Bank statements

- Business plan and financial projections

- Property information and appraisal

Having these documents ready in advance can help streamline the application process and demonstrate your financial stability and ability to repay the loan.

2. Research Lenders and Loan Options

It’s crucial to research different lenders and loan options to find the best fit for your business. Consider factors such as interest rates, loan terms, repayment schedules, and any specific requirements or restrictions imposed by each lender. Consulting with a commercial mortgage broker or financial advisor can help you navigate the options and make informed decisions.

3. Submit the Application

Once you’ve chosen a lender and loan option, it’s time to submit your application. Make sure to complete all the required forms accurately and provide any additional information or documentation requested by the lender. Depending on the complexity of the application, the review process may take several weeks.

4. Loan Underwriting and Approval

After submitting your application, the lender will perform a thorough underwriting process to assess your creditworthiness, financial stability, and the viability of the property as collateral. They will review your financial documents, credit history, and overall business performance. Upon completing the underwriting process, the lender will determine whether to approve or deny your loan application.

5. Loan Closing and Disbursement

If your loan application is approved, you will move forward to the closing stage. During this phase, you will review and sign the loan documents, pay any closing costs and fees, and provide any additional information required by the lender. Once the closing process is complete, the funds will be disbursed, and you can start using your commercial mortgage to finance your business needs.

Conclusion

Commercial mortgages are a valuable tool for businesses seeking financing to acquire or refinance commercial properties. By understanding the different types of commercial mortgages, their benefits, and the application process, you can make informed decisions and secure the financing that best suits your business needs. Remember to consult with professionals such as commercial mortgage brokers or financial advisors to guide you through the process and ensure you make sound financial choices. With careful planning and research, a commercial mortgage can be the key to unlocking growth and success for your business.