Welcome to our user-friendly guide on the essentials of conventional mortgages! In this comprehensive article, we will walk you through everything you need to know about conventional mortgages, from understanding the basics to navigating the application process. Whether you’re a first-time homebuyer or looking to refinance, this guide is here to help. Let’s dive in!

Understanding Conventional Mortgages

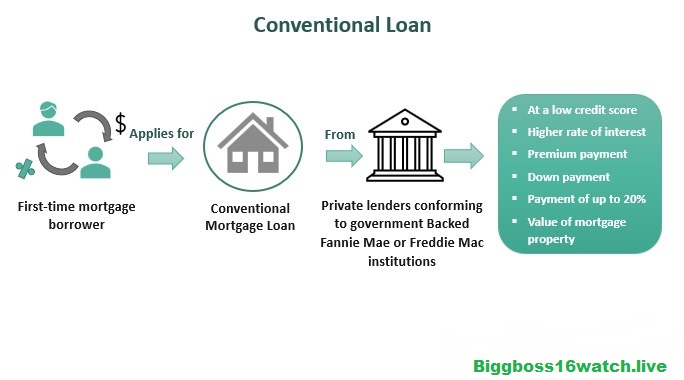

Before we delve into the details, let’s start by defining what a conventional mortgage is. A conventional mortgage, also known as a conforming loan, is a type of home loan that is not backed by a government agency, such as the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA).

Unlike government-backed loans, conventional mortgages are offered and originated by private lenders, such as banks, credit unions, or mortgage companies. They follow the guidelines set by two government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac.

How It Works Conventional Mortgages

A conventional mortgage is a type of home loan that is not insured or guaranteed by the government. Instead, it is backed by private lenders such as banks, credit unions, or mortgage companies. Here’s how conventional mortgages generally work:

- Application and Pre-Approval: To get a conventional mortgage, you typically start by applying with a lender. They will assess your financial situation, including your income, credit score, employment history, and other debts. Based on this information, they will determine if you qualify for a mortgage and how much you can borrow. Pre-approval involves a more thorough check of your finances and can give you a better idea of your budget when shopping for a home.

- Down Payment: With a conventional mortgage, you usually need to make a down payment, which is a percentage of the home’s purchase price. The down payment requirement can vary but is often around 3% to 20% of the home’s value. The size of your down payment can affect the interest rate you receive and whether you’ll need to pay for private mortgage insurance (PMI).

- Interest Rates: Conventional mortgages offer both fixed-rate and adjustable-rate options. With a fixed-rate mortgage, your interest rate remains the same throughout the life of the loan, providing predictable monthly payments. With an adjustable-rate mortgage (ARM), the interest rate may change periodically, typically after an initial fixed-rate period.

- Loan Terms: Conventional mortgages typically have loan terms of 15 to 30 years, with the most common being 30-year terms. Shorter terms usually come with lower interest rates but higher monthly payments, while longer terms have higher interest rates but lower monthly payments.

- Private Mortgage Insurance (PMI): If you make a down payment of less than 20% of the home’s purchase price, you may be required to pay for private mortgage insurance. PMI protects the lender in case you default on your loan. Once you’ve built up enough equity in your home (typically reaching 20% equity), you may be able to cancel PMI.

- Closing Costs: Like any mortgage, conventional loans come with closing costs, which can include fees for loan origination, appraisal, title search, attorney services, and more. These costs are typically paid at the closing of the loan.

- Repayment: After closing, you’ll begin making monthly payments on your mortgage. Each payment typically covers a portion of the principal (the amount you borrowed) and interest. With a fixed-rate mortgage, your monthly payments will remain consistent throughout the loan term. With an ARM, your payments may change when the interest rate adjusts.

- Ownership and Equity: As you make mortgage payments, you build equity in your home. Equity is the difference between the current market value of your home and the remaining balance on your mortgage. Over time, as you pay down your loan and potentially see increases in your home’s value, your equity grows, providing you with a valuable asset.

Advantages of Conventional Mortgages

Conventional mortgages offer several advantages that make them an attractive option for many borrowers. Let’s take a look at some of their key benefits:

- Lower Interest Rates: Conventional mortgages typically have lower interest rates compared to government-backed loans.

- No Mortgage Insurance: If you make a down payment of at least 20% of the home’s purchase price, you can avoid paying private mortgage insurance (PMI).

- Flexible Terms: Conventional mortgages offer a range of repayment terms, allowing you to choose the duration that suits your financial situation.

- Higher Loan Limits: Unlike government-backed loans, which have specified limits, conventional mortgages often have higher loan limits, giving you more options when purchasing a higher-priced property.

- Streamlined Refinancing: If you already have a conventional mortgage, refinancing it can be a straightforward process with potentially lower interest rates or shorter repayment terms.

Qualifying for a Conventional Mortgage

Now that you understand the advantages, let’s discuss the qualifications for obtaining a conventional mortgage. Lenders have specific criteria to determine your eligibility. Here are some key factors they consider:

1. Credit Score

Your credit score plays a crucial role in the mortgage approval process. Most lenders require a minimum credit score of 620 for conventional mortgages. However, a higher credit score can improve your chances of securing a loan with favorable terms.

2. Debt-to-Income Ratio

The debt-to-income ratio (DTI) is a measure of your monthly debt payments compared to your gross monthly income. Lenders typically look for a DTI ratio below 45%. A lower DTI ratio indicates that you have a manageable level of debt and are more likely to handle mortgage payments effectively.

3. Down Payment

Conventional mortgages usually require a down payment of at least 3% to 20% of the home’s purchase price. The specific amount depends on various factors, including your creditworthiness and loan program. A higher down payment can help reduce your monthly mortgage payments and may eliminate the need for mortgage insurance.

4. Employment and Income Stability

Lenders assess your employment history and income stability to evaluate your ability to make consistent mortgage payments. Ideally, they look for a stable job history and a reliable source of income. Self-employed individuals may need to provide additional documentation, such as tax returns, to verify their income.

Applying for a Conventional Mortgage

Now that you know the qualifications, let’s walk through the steps involved in applying for a conventional mortgage:

1. Preparing Your Finances

Before you apply for a mortgage, take the time to review your finances. Check your credit report for any errors and address them promptly. Gather your financial documents, such as income statements, bank statements, and tax returns, as lenders require them during the application process.

2. Shopping for Lenders

Research and compare different lenders to find the best fit for your needs. Look at their interest rates, fees, and customer reviews. It’s essential to choose a reputable lender with excellent customer service to ensure a smooth mortgage experience.

3. Getting Preapproved

Consider getting preapproved for a mortgage before starting your house hunting journey. The preapproval process involves providing the lender with your financial information, and they assess your creditworthiness to determine the loan amount you qualify for. Preapproval gives you a clear idea of your budget and makes you a more competitive buyer.

4. Submitting Your Application

Once you’ve found the right lender, submit your mortgage application. Be prepared to provide detailed information about your finances, employment, and the property you intend to purchase. Double-check all the documents to ensure accuracy and include any additional documentation as requested by the lender.

5. Underwriting and Approval

Once your application is submitted, the lender initiates the underwriting process. During underwriting, the lender verifies the information provided, assesses the property’s value, and evaluates your creditworthiness. If everything meets the lender’s requirements, they will approve your loan, and you will be one step closer to becoming a homeowner!

Congratulations! You have reached the end of our user-friendly guide on the essentials of conventional mortgages. We hope this comprehensive article has provided you with valuable insights and a better understanding of how conventional mortgages work. Remember, before making any decisions, it’s essential to consult with a trusted mortgage professional who can guide you through the process. Happy homebuying!